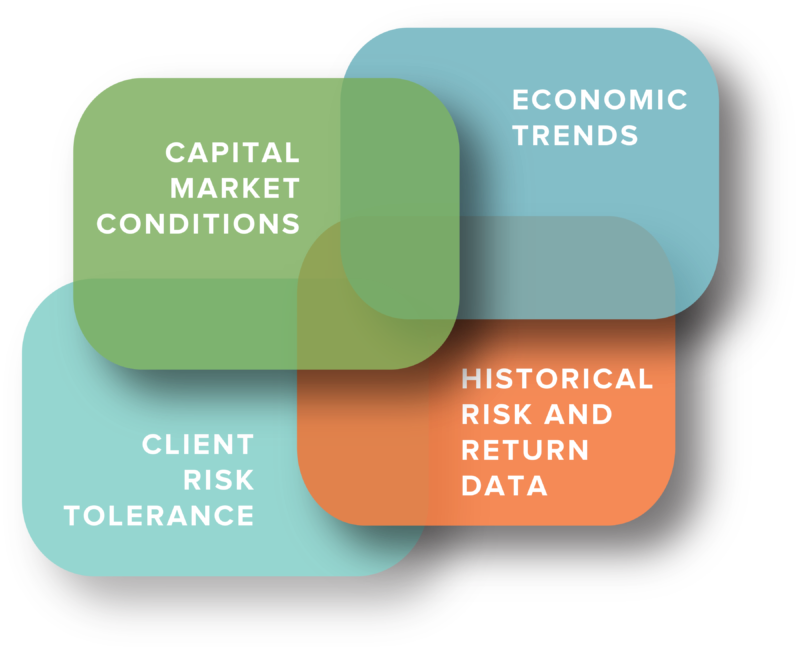

While our portfolio managers know how important it is to draw on their experience of numerous market cycles, we view investment management as an active process rather than a statistical study of historic trends. Effective asset allocation management considers current market conditions and economic indicators, but it also must factor in the short-term and long-term investment goals of each client. Because of our record of low staff turnover, our strength is combined with consistency.